Loan annuity formula

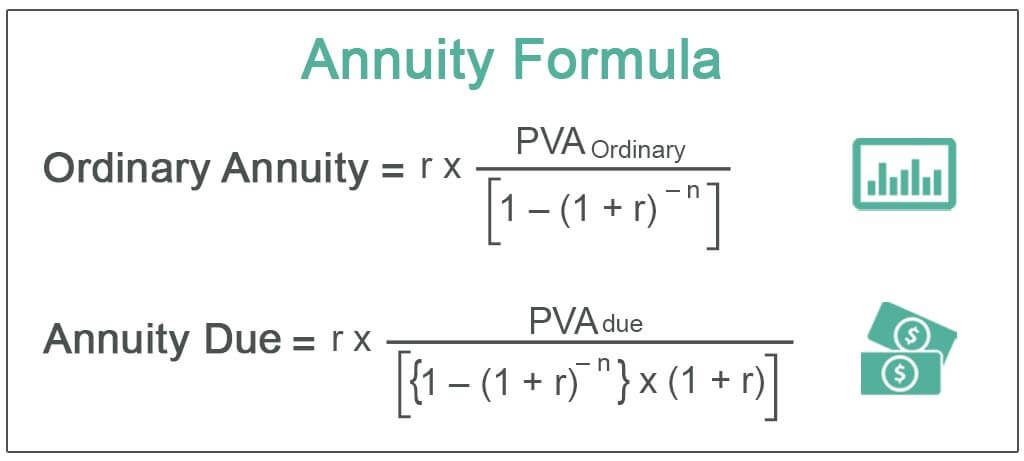

A loan by definition is an annuity in that it consists of a series of future periodic payments. Similarly the formula for calculating the present value of an annuity due takes into account the fact that payments are made at the beginning.

Present Value Of An Annuity How To Calculate Examples

Following is the formula to calculate annuity payment.

. The tenure of the loan is denoted by t Step 4. By rearranging the formula we can calculate how much each payment must be worth in order to equal a present value where the present value is the value of the loan. The fixed monthly mortgage repayment calculation is based on the annuity formula Annuity Formula An annuity is the series of periodic payments to be received at the beginning of each period or the end of it.

Of years which is denoted by t. See how the principal part increases and the. Examples of annuities are regular deposits to a savings account monthly home mortgage payments monthly insurance payments and pension payments.

An amortization schedule is a table detailing each periodic payment on an amortizing loan typically a mortgage as generated by an amortization calculator. Nper C612. But COVID and student loan debt are forcing people to take new routes to financial wellness.

Change the balance formula. Next determine the tenure of the loan or the period for which the loan has been extended. R PV 1 -.

Calculating the Present Value of an Annuity Due. An annuity is based on. The calculation for annuity deposits are similar to that of loan repayments.

Formula to Calculate PV of Ordinary Annuity. The rate does not change 2. Select the range A7E7 first payment and drag it down one row.

The first payment is one period. The principal is the current loan amount. An annuity is a series of payments made at equal intervals.

Your interest rate 6 is the annual rate on the loan. To calculate amortization you will convert the annual interest rate into a. What is Mortgage Formula.

It takes 24 months to pay off this loan. A mortgage is an example of an annuity. A portion of each payment is for interest while the remaining amount is applied towards the.

The formula for Amortized Loan can be calculated by using the following steps. Annuities can be classified by the frequency of payment dates. Next determine the loan tenure in terms of no.

Ordinary Annuity Formula refers to the formula that is used to calculate the present value of the series of an equal amount of payments that are made either at the beginning or end of the period over a specified length of time. Next figure out the rate of interest to be paid on the loan and it is denoted by r. If your loan has a balance outstanding of 100000 not counting any accrued interest that is the principal.

So at the end of five years he would end up paying a total of 11250. Finally the formula for simple interest can be derived as a product of outstanding loan amount step 1 interest rate step 2 and tenure of the loan step 3 as shown below. Amortization refers to the process of paying off a debt often from a loan or mortgage over time through regular payments.

The PV or present value portion of the loan payment formula uses the original loan amount. An exclusion ratio is used to determine the taxable and nontaxable percentage of a monthly annuity income payment. The present value of an annuity formula equates how much a stream of equal payments made at regular intervals is worth at current time.

The formula used to calculate loan payments is exactly the same as the formula used to calculate payments on an ordinary annuity. To calculate the monthly payment with PMT you must provide an interest rate the number of periods and a present value which is the loan amount. In this case you lend to the bank at the notified interest rates contrary to taking a loan from the bank.

It applies to nonqualified annuities. The payments deposits may be made weekly monthly quarterly yearly or at any other regular. As per the formula the present value of an ordinary annuity is calculated by dividing the Periodic Payment by one.

While variable annuities follow the same basic exclusion ratio formula a couple additional. Select the range A8E8 second payment and drag it down to row 30. An annuity is a series of equal cash flows spaced equally in time.

Firstly determine the current outstanding amount of the loan which is denoted by P. The future value of an annuity formula assumes that 1. In the example shown the PMT function is configured like this.

The formula for mortgage basically revolves around the fixed monthly payment and the amount of outstanding loan. Using this formula you will find that the amount of interest on Johns 7500 loan was 3750. This does not include any.

For example say you are paying off a 30-year mortgage. The future value of an annuity formula is used to calculate what the value at a future date would be for a series of periodic payments. The original loan amount.

Annuity Formula Calculation Of Annuity Payment With Examples

Annuity Payment Formula Pv Double Entry Bookkeeping

Annuity Calculator Excel Flash Sales 55 Off Www Ingeniovirtual Com

Annuities And Loans Math For Our World

Loan Payment Formula With Calculator

Annuity Due Formula Example With Excel Template

:max_bytes(150000):strip_icc()/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)

Annuity Due Definition

Pv Of Annuity W Continuous Compounding Formula With Calculator

Annuity Present Value Pv Formula And Calculator Excel Template

Annuities And Amortization Ppt Download

Excel Formula Payment For Annuity Exceljet

Present Value Of An Annuity How To Calculate Examples

Find Monthly Installment For Loan Present Value Annuity Example Youtube

Calculating Annuities

Loan Balance Formula Double Entry Bookkeeping

Solve For Remaining Balance Formula With Calculator

Finance Formulas Owll Massey University